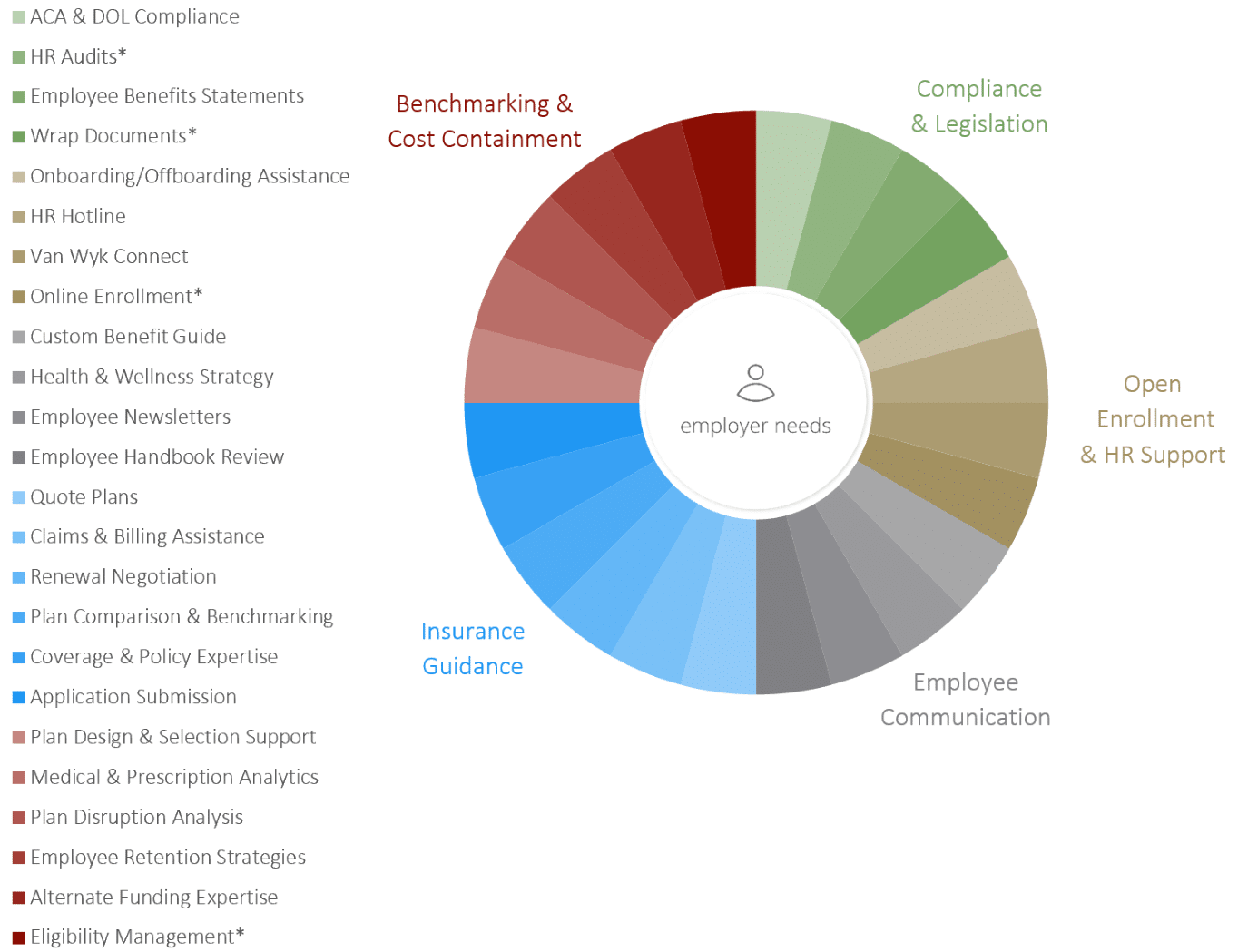

If your business is only focusing on renewal negotiation and plan comparison you may be missing costs that you have more control over.

Employee BenefitsSolutions

If your business is only focusing on renewal negotiation and plan comparison you may be missing costs that you have more control over.

Full Circle

Competitive employee benefits packages are essential for attracting and retaining quality employees.

But, continuing to offer competitive benefits can be tough with the rising cost of health care. Van Wyk Risk Solutions provides long-term benefit planning to strategically analyze ways to contain costs through various plan improvements and innovative solutions to improve HR efficiency.

Through vast experience, hands-on personal approach and creative thinking, Van Wyk Risk Solutions provides employee benefits solutions for organizations looking for a true partner. You can rest assured knowing we offer our services with only your best interest in mind.

What plan improvement strategies would best serve your employees and long term business goals?