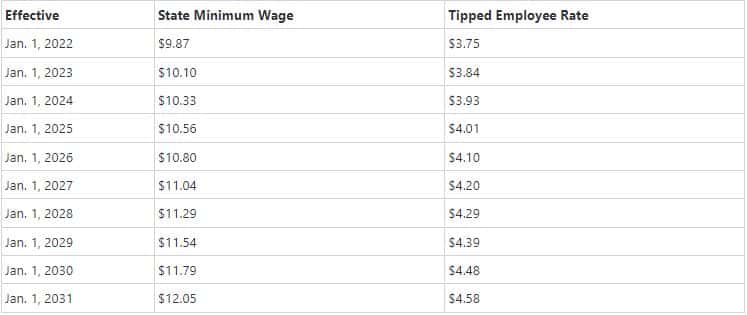

Minimum Wage Rate

All employers that have two or more employees in Michigan must comply with minimum wage payment requirements under the IWOWA. Minimum wage increases were set by Public Act No. 368, which amended the IWOWA in late 2018. Under the amendments, the minimum wage rate will increase annually until it reaches $12.05 per hour.

Even though the rates in the table above represent the official schedule, state law prohibits scheduled increases when the state’s annual average unemployment rate for the preceding calendar year is above 8.5%. This was the case in 2020, which resulted in no increase for 2021.

Covered Employees

- Child care providers (unless they are under age 18, only provide services on a casual basis and do not regularly work an aggregate of more than 20 hours per week); and

- Domestic service employees who provide companionship services (as defined by the FLSA) for persons who, because of age or infirmity, are unable to care for themselves.

Exceptions

- Ice hockey players who are between 16 and 21 years of age and play for a team that is part of a regional, national or international junior ice hockey league;

- Individuals covered under the FLSA (unless the state minimum wage rate is higher than the federal minimum wage rate);

- Individuals exempt from the minimum wage rate under the FLSA;

- Individuals employed in summer camps for not more than four months;

- Individuals working under a special certificate issued by the U.S. Department of Labor; and

- Fruit, pickle and tomato growers and other agricultural employers that traditionally contract for harvesting on a piecework basis.

Posting Requirement

For More Information

Contact us today via the form below for more information on wage payment and work hour laws in Michigan. And be sure to like us on Facebook and follow us on LinkedIn for more news and industry tips.